The Central Bank of Nigeria has provided funds to power distribution companies for the purchase of 704,928 meters and for the acquisition and installation of over 500 transformers.

In a bid to avert the collapse of the country’s power sector, the bank has also paid more than N24bn to gas suppliers and rehabilitated over 2,000 kilometres of 11kV lines and 130km of 0.45kV lines.

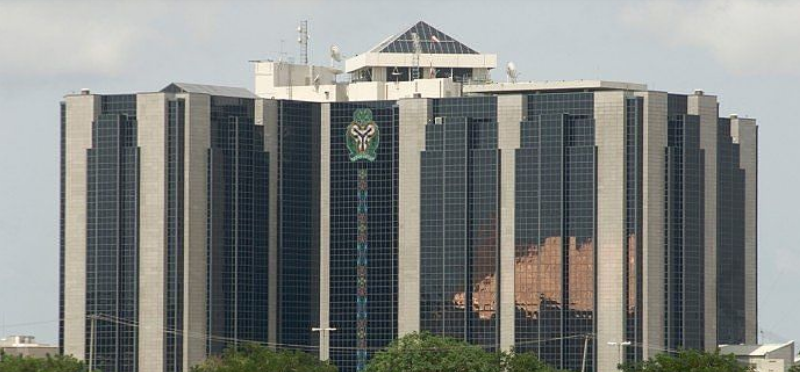

The CBN said its intervention in the power sector was through the Nigerian Electricity Market Stabilisation Facility, as captured in the NEMSF Progress Report, which was presented to operators in the industry at the 27th power sector monthly meeting.

The report, which was obtained by our correspondent from the Federal Ministry of Power, Works and Housing in Abuja on Monday, stated that the facility also helped the Discos to provide N13.78bn of security cover to the Nigerian Bulk Electricity Trading Company and the Market Operator as required under the vesting contracts/market rules.

It stated that other outcomes of the intervention include “the purchase of 704,928 metres through the facility, purchase and installation of over 500 transformers to enhance the distribution networks, and over 2,000km of 11kV lines and 130km of 0.45kV lines were rehabilitated.”

It added, “More than 1,000 megawatts of generation capacity was recovered, 56 substations were rehabilitated/constructed, and over N24bn has been paid to gas suppliers to ensure adequate supply of gas to the Nigerian power sector.”

Following the privatisation of the electricity supply industry in 2013, it has had to grapple with several challenges, chief among which is revenue shortfalls.

The shortfalls, which had risen to N210bn by December 2014, threatened the survival of the industry and by extension, the Nigerian economy.

“In order to prevent a collapse of the industry, the CBN intervened to provide liquidity and stabilise the sector through the Nigerian Electricity Market Stabilisation Facility,” the bank stated in the latest NEMSF progress report.

It noted that the core objectives of the facility was to reset the economics of the power sector by way of providing liquidity to the industry by settling the debt overhang that arose during the interim rules period as a result of revenue shortfalls during that time.

The report stated that it was the apex bank’s aim to also bring about a contract-based electricity market where participants were being governed by market rules and instill discipline, as well as facilitate tangible improvement in power supply across the country.

On disbursements and repayments from the NEMSF as of May 14, 2018, the report stated that the total amount was N210.63bn, out of which N158.74bn had been disbursed, representing 75 per cent of the fund. It added that N19.35bn had been repaid, leaving an outstanding balance of N139.39bn.

The apex bank said, “The outstanding disbursement of N51bn under the facility is mostly as a result of the Kaduna and Yola Discos that are yet to fully sign on to the facility. Efforts to sign on these Discos are already been intensified as both Discos have made remarkable progress in this regard.”

“The CBN is desirous of unlocking more liquidity into the industry and is providing the necessary support to these Discos to ensure that they are on-boarded to the facility within the year.”

Culled from The Punch